- MOST AFFORDABLE CPA STUDY MATERIAL HOW TO

- MOST AFFORDABLE CPA STUDY MATERIAL SOFTWARE

- MOST AFFORDABLE CPA STUDY MATERIAL LICENSE

Students will study the financial trends of banks and major corporations to better inform their decisions.

MOST AFFORDABLE CPA STUDY MATERIAL HOW TO

Financial Management Course: This course in advanced economics teaches students how to make quick and good decisions on behalf of an individual or a business as part of a financial firm.Business law may be a lucrative area of accounting, and some people may like to become certified accountants online. Business Law Course: Courses in business law are common to many graduate CPA programs and teach the basic legalities surrounding businesses that apply to finance taxation and accounting.Understanding accounting is an excellent CPA skill acquiring, so courses in this topic are great for those wishing to study accounting online.

MOST AFFORDABLE CPA STUDY MATERIAL SOFTWARE

Online courses in accounting information systems may include technical components like specialized software that analyzes business processes and improves the efficiency of financial record-keeping systems through hands-on computerized methods.

Students explore and learn how to use current systems, based on contemporary accounting measures demands.

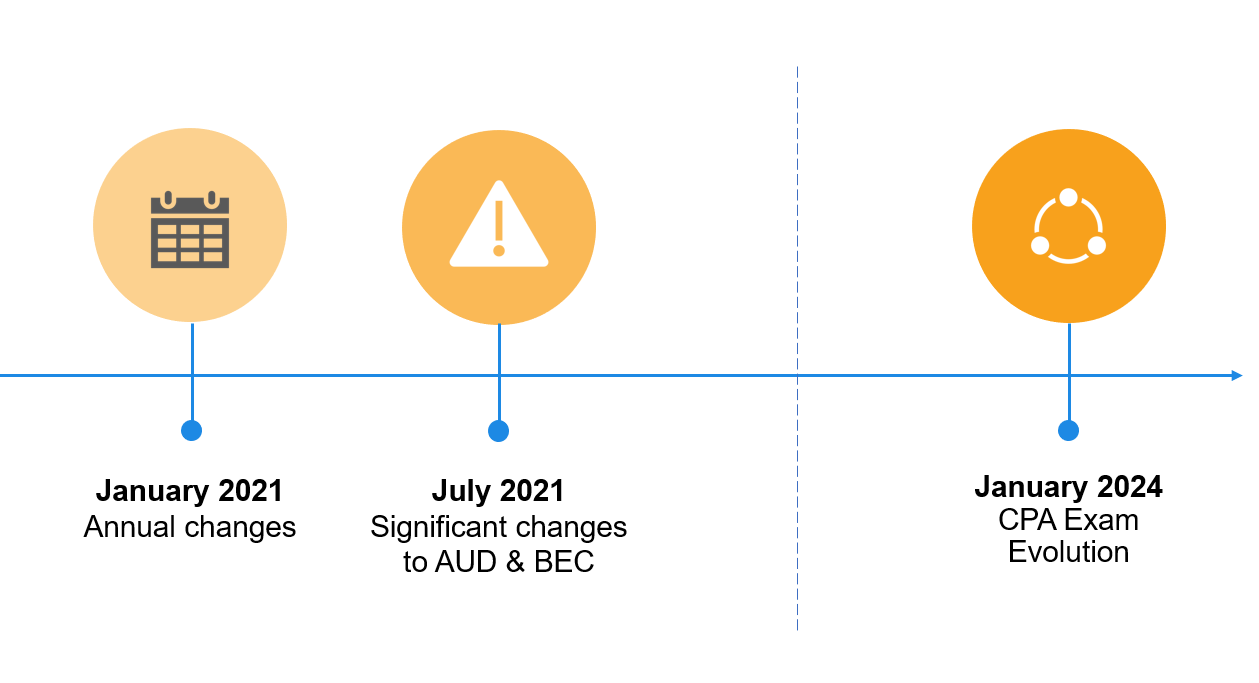

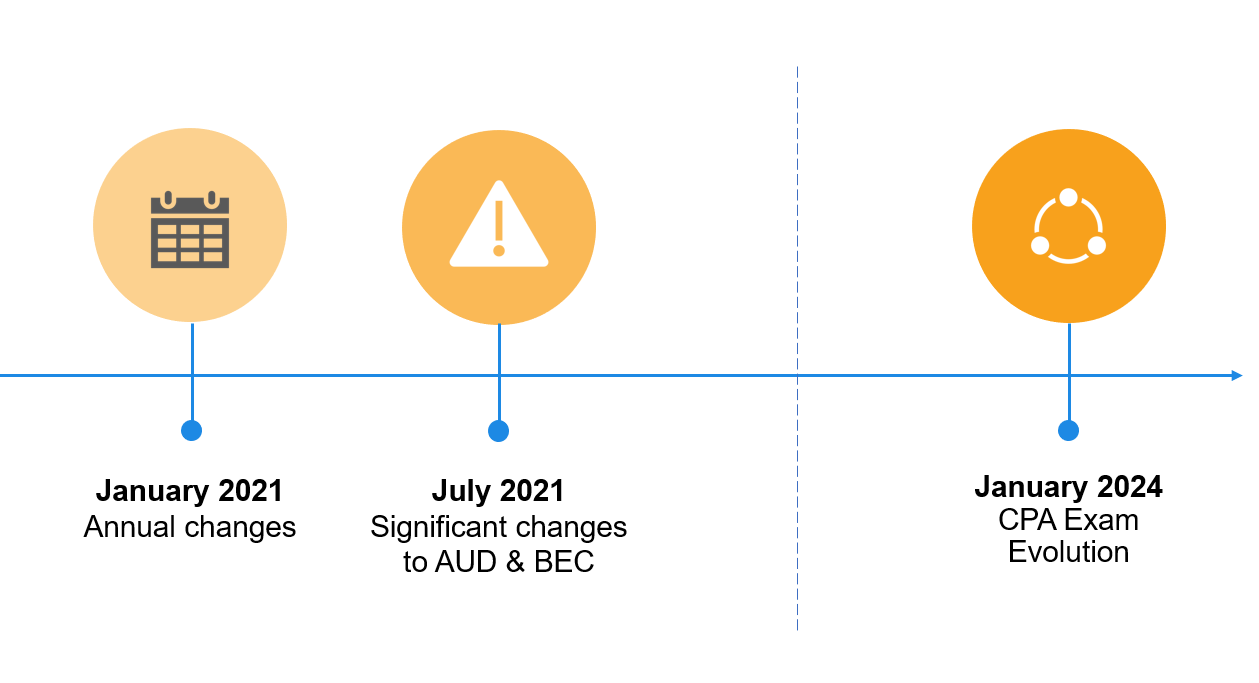

Accounting Information Systems Course: Accounting information systems courses are increasingly relevant to changing technologies in accounting and are included mainly in the certificate and graduate-level CPA degree programs. It is also commonly addressed in degree and graduate-level certificate programs. cost accounting is explored by students as early as the junior year of a bachelor’s degree program. CPAs use cost accounting principles to help businesses and self-employed people with tax deductions and financial planning. Cost Accounting Course: This is another common type of CPA subject in the accounting industry that deals with the management and reporting of expenditures. It can be applied to many accounting subspecialties, including management, government, and public accounting. Auditing courses use certain methods to investigate fiscal statements and is presented in a broad context, especially at the undergraduate level. Auditing Course: Auditing is another type of undergraduate CPA course that may be available online. Some courses on federal taxation might be specific and cover tax policies pertaining to companies or persons. It is usually an upper-level undergraduate CPA course topic and courses on taxation examine the tax laws of the current calendar year in many cases. Federal Taxation Course: Federal taxation refers to the policies, laws, and procedures concerning nationally mandated taxes on property, businesses, and individuals. This theory-oriented CPA material can be easily communicated through text, therefore online technical requirements for financial accounting courses are minimal. This course covers the general theories related to the CPA profession and how financial data is reported. Similar courses can be taken during graduate-level programs. Financial Accounting Course: These are broad courses on financial accounting usually taken during a student’s sophomore or junior year. There are various CPA-related courses in accounting that students can take online through a variety of post-secondary institutions. Best CPA prep courses for 2022 Types of Online CPA Prep Courses. In this simple-to-digest article, you’ll get to know These courses also accommodate various learning styles (online tutoring, chat, in-person lectures, etc.) through a variety of modalities. It helps candidates to study the material down in bite-size pieces. Online CPA prep courses are courses that make studying for a CPA exam less daunting. There’s only an 18-month window for candidates to pass all four sections. The sections include Business Environment and Concepts (BEC), Auditing and Attestation (AUD), Financial Accounting and Reporting (FAR), and Regulation (REG). Each section of the CPA exam is based on a specific area of accounting and needs candidates to display a deep understanding of that subject area. MOST AFFORDABLE CPA STUDY MATERIAL LICENSE

A CPA license is hard to get because of the CPA Exam.

0 kommentar(er)

0 kommentar(er)